Introduction

Al Rayan Bank is one of the UK’s fully Shariah-compliant banks. This post analyzes its financial statements to examine how much of its assets and liabilities are effectively priced at interest — and what this reveals about Islamic banking in practice.

The UK is often presented as being a hub of Islamic finance. It is certainly true that there is a significant amount of activity that is connected to the UK.

I wish to focus on the aspect of Islamic banking in the UK that provides banking services to Muslim customers in the UK. In a document published by the UK government, there are listed 5 fully Shariah compliant banks in the UK:

- Abu Dhabi Islamic Bank

- Al Rayan Bank

- Bank of London and the Middle East

- Gatehouse Bank

- QIB UK

I will analyse the activities of a bank that provides products and services to Muslim customers in the UK (this is where I live).

Before I begin, let me make some things clear:

1) This bank operates in a manner consistent with Islamic retail banks across the world. I do not expect to find any of their offerings to be different, in any meaningful manner, to products offered by other Islamic retail banks globally.

2) I am examining one specific angle in my analysis, and that is to establish what portion of its activities are priced at interest. This is not to say that these activities involve Riba, or interest. Contractually, all Islamic banks are prohibited in transacting in interest (Riba). However, this does not prevent banks using interest as pricing for its products and services.

3) I have selected the bank simply because I am British and I live in the UK. I have conducted this exact analysis on Islamic Banks in Malaysia, Kuwait and Saudi Arabia also. The results are very similar.

Ok, in order to analyse the activities of the bank, there is no better place to begin than the financial statements. The bank provides access to the Financial Statements for the year ended 31 December 2018 on its website.

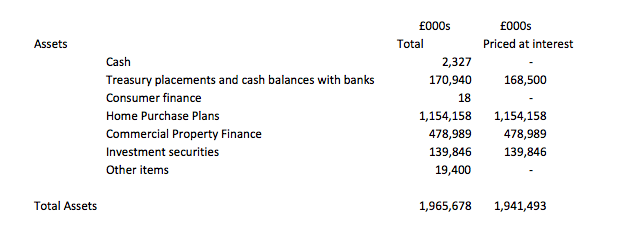

Total Assets

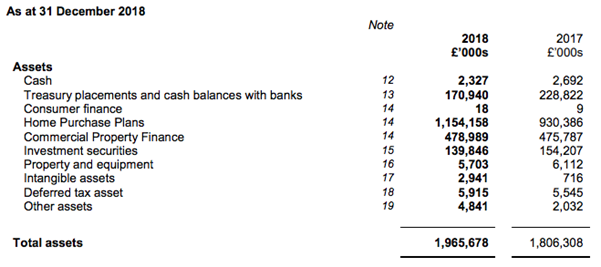

The financial statements show that total assets of the bank are £1.966bn, total liabilities are £1.831bn and equity totals £135mn.

We will work through each of these sections in turn.

Cash

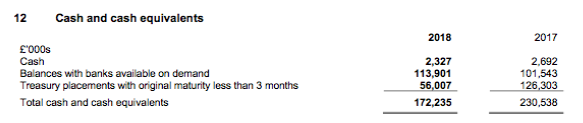

We can see that cash totals £2.327mn. This balance is further explained in note 12:

As the bank is a retail bank, it will keep cash in it’s branches. The website informs us the bank has five branches across the UK, and thus I presume that this £2.327m cash comprises cash maintained at its branches.

Treasury placements and cash balances with banks

This balance of £170.940mn is split between two items as per note 12 above. £113.9mn is balances with banks available on demand, and £56mn as Treasury placements with original maturity less than 3 months.

The notes make it clear that the bank is obliged to maintain a non-interest-bearing account with the Bank of England amounting to 0.18% of the average eligible liabilities in excess of £600mn. I am not privy to the detailed calculation of this amount, so we can estimate this to be 0.18% of liabilities on the financial statements in excess of £600mn. Total liabilities are £1.965bn and hence the amount in excess of £600mn is £1.365bn, and 0.18% of this amounts to approximately £2.5mn.

This means, that of the £171mn amount in this line on the financial statements, a total of £2.5mn is estimated to be in non-interest-bearing accounts held at the Bank of England.

The remained of the balance of £171mn (being £168.5mn) will be balances with banks and treasury placements that do attract interest. This is the normal operation of all banks, including Islamic banks. It may be that some of these placements that are available on demand may attract no interest or profit amounts at all, as they are on demand. However, this would be a consequence of the money being on demand, rather that the in ability of the bank to contractually receive a profit on these amounts.

Any profit received by the bank on these amounts will naturally be priced at interest. Of course, I do not expect any contract that the bank signs to explicitly contain interest. However, these deposits and balances will attract profit amounts that are priced at interest. This point will be easier to illustrate once we look at other items on the financial statements.

Consumer Finance is a small amount, so I will move on to the next line in the statements.

Home Purchase Plans (HPP)

This amounts to £1.154bn and is the largest item listed as assets, and it comprises almost 59% of all assets of the bank. It is clear this is an important part of the bank’s overall business.

This item is covered in note 14 to the financial statements. This note does not provide any further breakdown of this figure. We can look at the bank’s website to find out more about the HPP.

We are informed that:

“The compliant Islamic mortgage alternatives (Home Purchase Plans or HPPs) are based upon the Islamic finance principles of co-ownership (Diminishing Musharaka) and leasing (Ijara).”

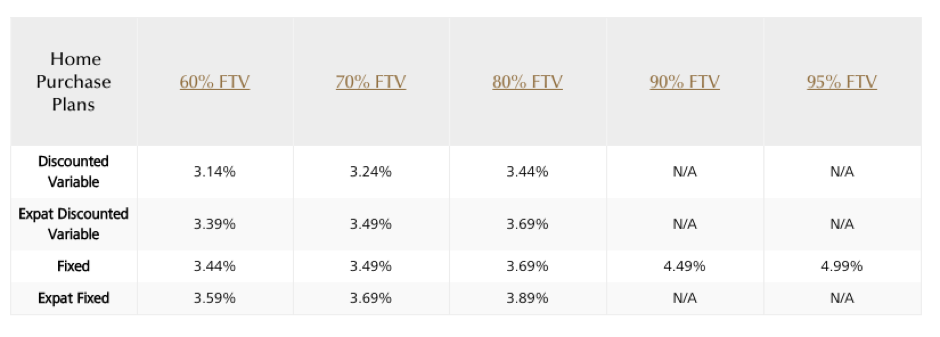

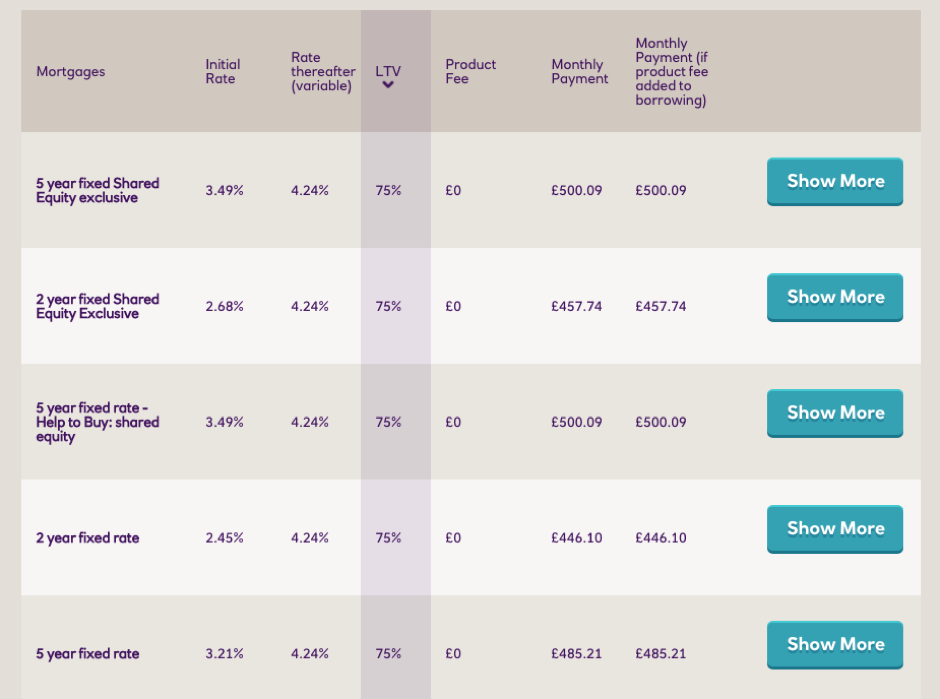

In my experience, these financing products are priced at interest. We can see on the website, the following illustration of current pricing on the bank’s HPP offering:

These are presented as interest rates. However, in contractual terms, these are not interest payments. Instead they represent payments from the customer to the bank that occur as rental payments. It is clear that the rental payments are not benchmarked to the rental value of the property, as that is irrelevant to the risk that the bank is taking by providing home finance to the customers.

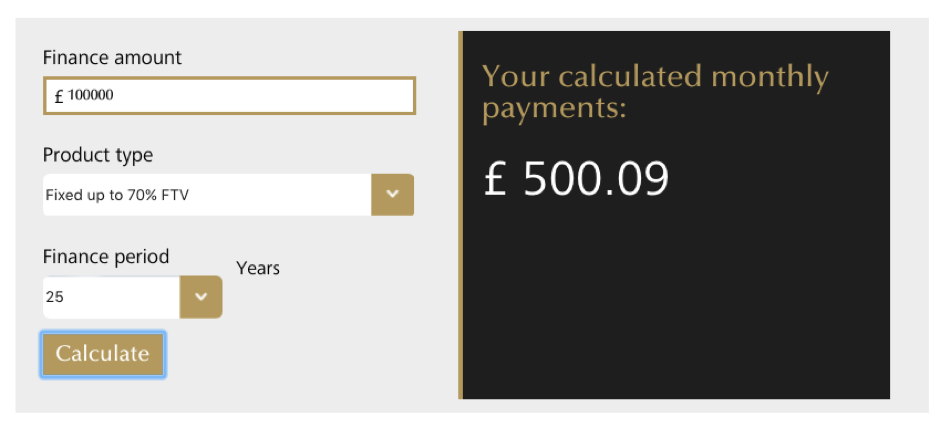

The bank provides a convenient HPP payment calculator on its website.

We can quickly check the HPP repayments based on figures that we can choose. If we select the 70% FTV plan (priced at a profit rate of 3.49% as illustrated above), and if we select a financing amount required of £100,000 (assuming a deposit of £40,000), and a repayment period of 25 years, then the calculator provides the following data:

This is profit, or rental amounts paid by the customer to the bank. This is not interest, as per the contractual arrangements between the bank and the customer.

Next, let us go the website of Natwest Bank, which is not an Islamic bank, yet it offers several interest-based mortgage products to UK customers. We can input the same financing requirements (£40,000 deposit, £100,000 financing, over 25 years, and we get the following results, showing us the different mortgage products offered with those parameters:

Let us look a bit closer at the third result. We can see that is a 5-year fixed rate mortgage, and the initial rate is fixed at 3.49% for 5 years. This equates to monthly repayments of £500.09.

This is exactly the same as the monthly repayment calculated on the Islamic bank’s website, also being £500.09 per month. Of course, that is profit, or rental amounts. The amount expressed by Natwest is interest payments.

This is a very good example of why I say these HPP products are priced at interest. The example we looked at has exactly the same price as that particular (interest-based) mortgage offered by a conventional bank.

Indeed, the contractual forms will be very different. Natwest will simply give a mortgage loan to the customer and charge interest. The Islamic bank will purchase the property from the market and then lease the property to the customer. However, the payments made by the customer are exactly the same, down to the last penny.

This is why I can comfortably conclude that the HPP products offered are priced at interest.

Commercial Property Finance

This asset is valued at £479mn. We shall investigate whether this product is priced at interest, or not.

As this is a more specialised product that home financing, the bank does not provide any useful information for our analysis (and it is not obliged to). However, based on my experience of the markets, and how Islamic banks (and conventional banks work), there can be no other conclusion than stating that this product is priced at interest.

Investment Securities

This amount is listed at £139.9mn, and is explained in note 15 to the financial statements.

It is clear that these securities comprise wholly of quoted Sukuk instruments. Sukuk is an Islamic version of a bond. All Sukuk instruments are priced at interest. This is not a matter that can be disputed in any manner whatsoever. It is not an opinion – it is clear and plain fact.

Of course, the payments made to Sukuk holders are not interest payments, because that would make the Sukuk a non-Shariah-compliant instrument. Instead the payments (even though they are transparently calculated and priced at interest) represent, contractually, a return to investors based on the purchase of relevant assets. But the fact remains, these returns are priced at interest.

Other Assets

The remaining four types of assets (listed as Property and equipment, Intangible assets, Deferred tax asset and Other assets) are not material in terms of size, and are not assets that are typically priced at interest. Hence there is no need to conduct further analysis on them at this time.

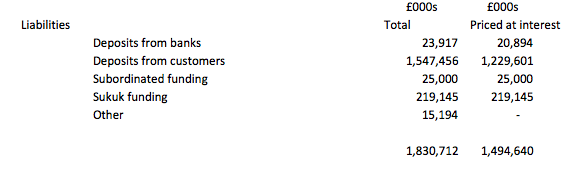

We can now turn our attention to liabilities.

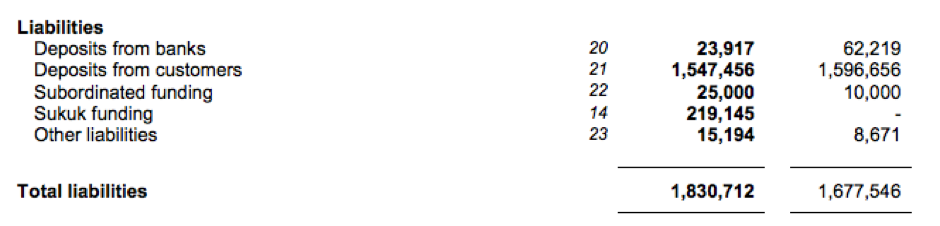

Liabilities

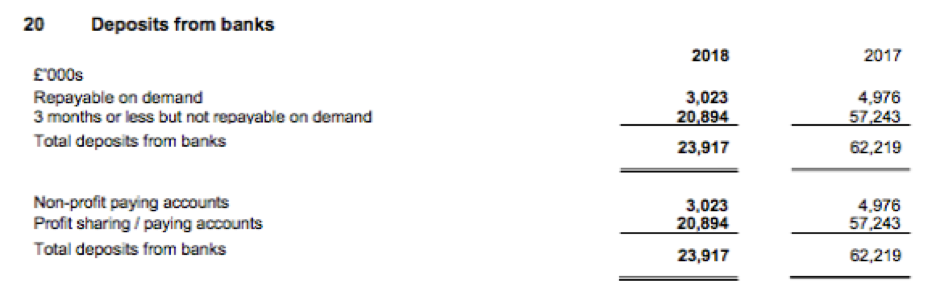

Deposits from Banks

These total £23.9mn and are explained in note 20.

We can see that £3.0mn of this amount comprises “Non-profit paying accounts” (this is because they are repayable on demand, and hence the bank is not obliged to deliver any profit to the bank that has placed the deposit. I could argue that these are products that are priced at interest, and that the price for these repayable on demand deposits is set at 0%, and I would, of course, be correct. However, technically, there is no obligation on this bank to pay these banks.

The remaining amount of £20,89mn are profit sharing deposits from banks. Profit sharing is calculated with reference to interest.

These are institutional deposits from other banks and as such, there is no expectation that the bank will provide any transparency on these on their website. However, having spent my career in creating the framework (and legal contracts) for exactly these kinds of transactions. I can say that these are priced at interest. The typical contractual forms that these payments would take would be either Commodity Murabaha contracts, or Mudarabah/Wakala contracts. The former specifies the profit amount that this bank will pay to the other bank (and this profit amount is always priced at interest, even though contractually it is presented as a profit on the buying and selling of relevant assets). The latter represent some form of enterprise and profit sharing contracts (Mudarabah and Wakala) and these products are still, without exception, priced at interest. I acknowledge that it is not that easy to demonstrate via public information that is available, because these kinds of transactions are not typically widely discussed in public forums. However, again, my direct experience in these markets and contracts forces me to state that, without exception, all these transactions are unequivocally priced at interest.

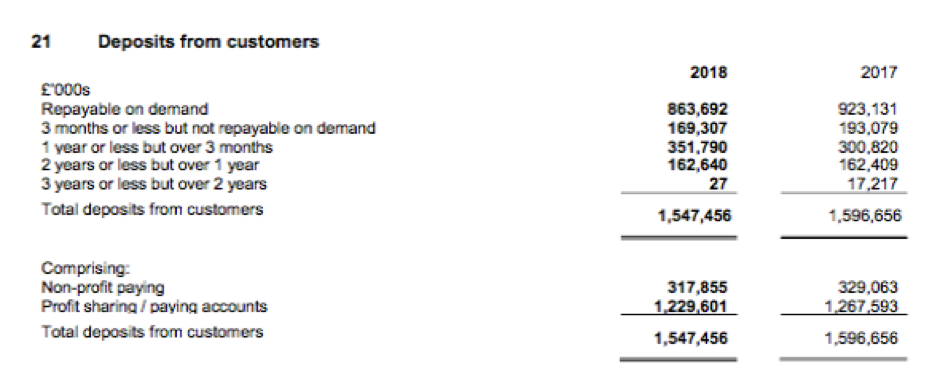

Deposits from Customers

These total £1,547bn and comprise 84.5% of all liabilities of the bank. Clearly, this is a fundamental part of the bank’s business. Further information is provided in note 21 to the financial statements.

The bottom part of this information is relevant to us. We can see that £317mn of customer deposits are non-profit paying, and that the remaining £1.230bn is profit paying. We can look at the bank’s website for further information.

For example the bank offers 3 kinds of term savings accounts:

- Instant access savings accounts

- Notice savings accounts, and

- Fixed term savings accounts

Instant Access Savings Accounts

The bank provides an overview of the profit rates payable on these accounts:

These are listed as Expected profit rates, and that is due to the nature of the contract that is executed between the customer and the bank. More on that shortly.

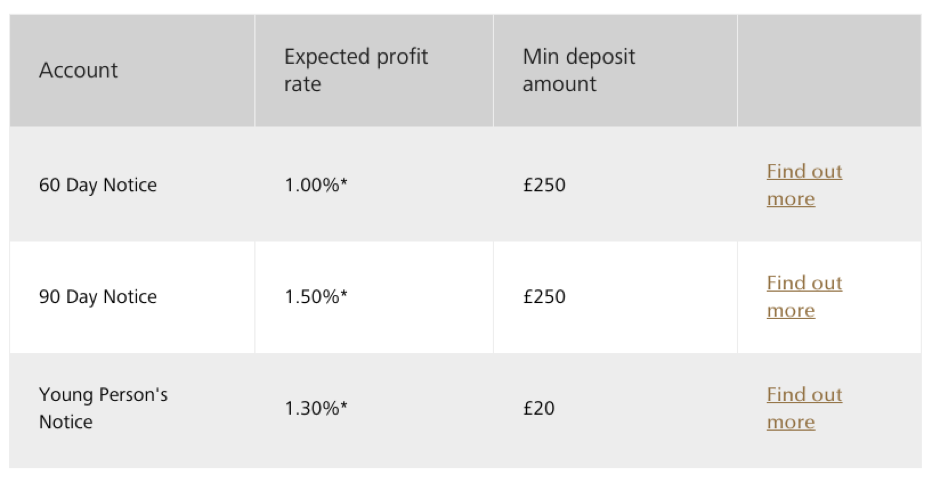

Notice Savings Accounts

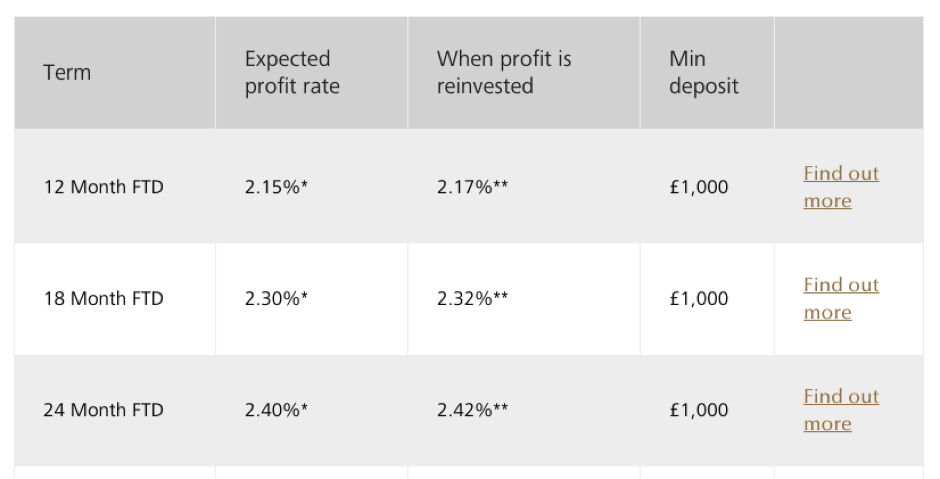

Fixed Term Savings Accounts

All of the expected profit rates are presented at interest –this neatly answers my question of whether these products are priced at interest.

Expected Profit vs Guaranteed Profit

The bank provides a guide on the explanation of Expected Profit on their website. It is a very common method of describing this that is used by Islamic banks everywhere. The main reason is that guaranteed profit can not be attributed in some contractual forms such as Mudaraba and Wakala. These can only result in an expected profit that the bank will aim to achieve. This puts Islamic banks on a very different footing compared to conventional banks that clearly state how much interest is to be paid to their customers.

However, if the reader takes a look at some articles on my blog, the real mechanism of how such “profit sharing” accounts work, and how “expected profit” is another name, in all practical and meaningful senses, for a guaranteed interest-priced return, is explained in some detail.

In every single instance in Islamic banking – Expected Profit is a mechanism whereby the bank tries to make it as clear as possible that the customer will receive a specific return (priced at interest) but the bank is not permitted to make this explicit statement. The bank is forced to refer to Expected Profit. This is semantics used by all Islamic banks to give the impression of operating within the constraints of Shariah. The practice is very different.

Subordinated Funding

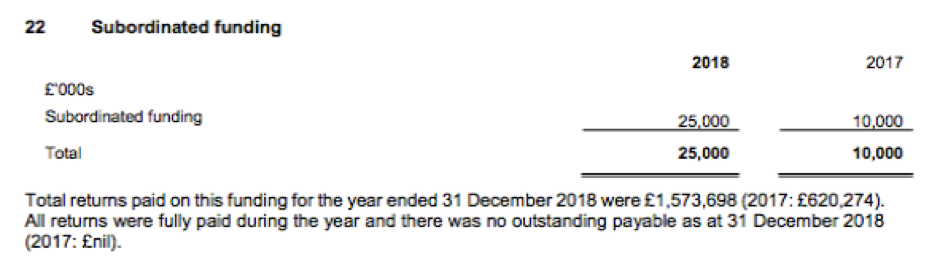

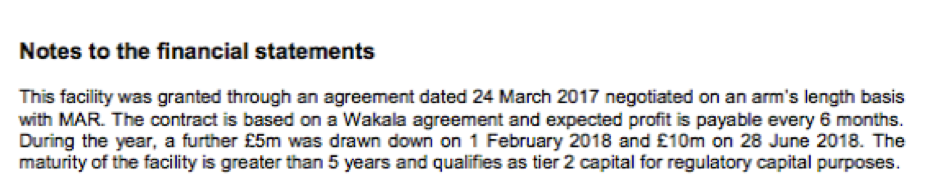

This is listed at £25mn, and further information is provided in note 22:

This tells us that the bank raised a new amount of £15mn of Subordinated funding during 2018. We are unable to calculate the effective “profit” rate paid by the bank during 2018, because the size of Subordinated funding was not constant throughout the year.

However, the notes provide some further useful information:

MAR stands for the owner (parent company) of this bank. Hence this is some form of financial support from the parent company, and profit is payable by the bank to its parent. The contract takes the form of a Wakala contract. If this was a commercial Wakala financing contract (ie not with the parent company) then there can be no doubt that this contract would be priced at interest, regardless of the contractual form of Wakala. In this instance, I would expect that the parent company would allow more lenience to this bank to pay differing (ie lower) amounts to service this financing. As such, I would still conclude that this subordinated funding is priced at interest, subject to any additional beneficial arrangements that one may expect to find in a funding arrangement between a bank and its owner.

Sukuk Funding

This amount is stated at £219mn and is very interesting. This is explained further in note 14:

We can see that the Sukuk was launched at a size of £250mn and that the bank repaid a principal amount of £30.855mn during the year, leaving an outstanding amount of £219.145. This Sukuk is claimed to be the largest ever Sukuk issued in GBP, and indeed is larger than the UK sovereign Sukuk issued on 2014 (which was of size £200mn).

This Sukuk was issued on or around February 2018.

According the Financial Times, the bank bundled together nearly 1,700 HPP together as security for this Sukuk. The Sukuk is rated at AAA, and the return on it is “0.8% above LIBOR” according to the FT website. Reuters presents the pricing as “80 basis points over the 3 month London interbank offered rate (Libor)”.

This makes is clear the Sukuk is priced at interest (or a spread over LIBOR).

This makes this Sukuk like every other Sukuk that has ever been offered – they are all priced at interest, or at a spread over an interest benchmark.

This is actually a very interesting structure, and I may well decide to analyse it later in some detail and write about it.

However, for our purposes, it is simple enough to establish that this Sukuk, appearing as a liability in the financial statements of the bank, is priced at interest.

Other Liabilities

These are listed at £15mn in the financial statements, and as such are not material for the purposes of our analysis.

Summary of Findings

We can summarise our findings as follows:

For Assets

We can see that the proportion of all assets that are priced at interest is 99%.

For Liabilities

Here, we can see that the proportion of all liabilities that are priced at interest is 82%. This number is reduced due to the number of customer deposits that are non-profit paying. Now, it is quite lenient of me to exclude these.

Let me explain – they are currently excluded because it is technically incorrect to claim they are priced at interest – because they do not deliver any profit at all to customers.

However, the fact that they do not deliver any profit is due to the commercial arrangements – customers who place funds in current accounts can often expect no interest to be paid to them. This does not mean that the product is not a product that is not priced at interest – it could be claimed that it is indeed priced at interest – and that the interest (in this case) is set to zero.

If we were to say that these deposits were priced at interest, then the proportion of assets would rise to 99% of all liabilities being priced at interest.

I had a brief look at the financial statements of Royal Bank of Scotland (the owner of Natwest bank) and they had customer deposits listed at £238bn but included no further breakdown of whether these were held in interest-bearing or non-interest-bearing accounts.

As such, it is reasonable to conclude that these customer deposits are funds that the bank receives from customers and both parties have agreed that there should be no profit/interest paid to the customer. This is a commercial agreement and is in line with the provision of such accounts (being on-demand current accounts) in the UK, and in other parts of the world.

As such, I can designate these funds as liabilities that are priced at interest, or certainly capable of being priced at interest, subject to market conditions. As such, I feel comfortable including them, in this analysis, within the portion of liabilities that are priced at interest.

I also feel this is in line with the spirit of this analysis. Ultimately, I am looking at what portion of a bank’s assets and liabilities are priced at interest (ie guaranteed) and what portion are actually priced in line with the stated aims (of the bank and of the global Islamic banking industry) on terms of profit sharing and risk sharing.

These funds can in no way be priced on a real profit sharing basis, because the use of these funds is the same as the use of all other funds placed at the bank, and that is reflected in the assets of the bank. Of all the bank’s assets, 99% are priced at interest. So to expect any of the cash liabilities of the bank to be priced at anything other than interest is beyond fanciful.

My Conclusion

Let me state clearly, I have nothing against this bank. It appears to be a very professional entity, and its website is informative and clear. They provide some very useful booklets and brochures that explain their ethos and their products. Their pricing is transparent. They make a very wide range of useful tools available to customers.

In many ways, they set a very good example to other banks of how to present their products in a professional manner, and how to engage positively with their customers.

However, the purpose of my analysis is very specific. It is to analyse what portion of assets and liabilities of the bank are priced at interest. And I find that 99% of all assets, and 99% of all liabilities of the bank are priced at interest.

Let me be clear – this is not very different to what I would expect if I conducted this same exercise for other Islamic banks globally.

I recently analysed at the financial statements of a significant Islamic bank in Malaysia, and also arrived at a figure of 99%.

I have also analysed, in some detail, the financial statements of some of the largest Islamic banks in the world, and the figures were in the range of 85%-98%. This is for my fourth book in my “Islamic Banking in Practice” series.

The slight reduction for these banks was due to the diversification (albeit not very significant) into other assets that are not typically held by banks. I presume this was a consequence of the very large size of these banks and also of the fact that these banks do not operate their investment businesses through separate legal entities, so I saw some assets that were typical investment type assets and not typical banking assets.

What can we conclude from this?

At the moment I propose to conclude nothing more than 99% of all the assets and liabilities of this bank are priced at interest.

Why this is the case is a matter for debate.

How this is achieved via Shariah compliant contracts such as Murabaha, Ijara, Musharakah, Mudarabah and Wakala is a technical issue, and I explain some of these issues in other articles.

We can certainly claim that such contracts promote and enable genuine transactions where risks and profits are shared – but the reality is that these contracts are priced at interest, virtually without exception in the Islamic banking industry.

Whether we think this is acceptable, unavoidable, or worthy of criticism is a matter of subjective opinion.

I have tried as much as possible to avoid presenting my opinion during this analysis.

Of course, if any reader disagrees with my analysis, please feel free to contact me and inform me where I am incorrect. (Twitter : @SafdarAlam).

It is quite possible that I have made some serious errors in my assumptions, or calculations, and I am very open to being corrected. I am only a human being and very capable of making errors. I admit that freely.

If any reader dislikes my analysis, that is not really my concern. I would prefer to base my opinions on facts and analysis, not mis-perception arising from a lack of knowledge.